WHITE PAPER

The 2024 Smarter Purchasing Report

How Pharmacies Leverage Smarter Purchasing to Unlock Savings and Enhance Their Operations

The 2024 Smarter Purchasing Report accounts for current challenges, including staff and drug shortages, while updating trends observed last year.

SureCost publishes its Smarter Purchasing Report each year to highlight how pharmacies save money and optimize their work. This is a dynamic field, and pharmacies want to do more than just stay in business. We’re proud to help pharmacy professionals learn how to thrive in this competitive industry. This year’s report showed us some surprising results and familiar trends. More importantly, it generated powerful insights for any pharmacy looking to save more while working smarter and staying compliant.

Methodology

SureCost collected anonymized purchasing data from its customers in 2023. This was a nationwide cohort of pharmacies working in both retail and long-term care (LTC).

We removed outliers to standardize this data for an accurate “apples to apples” comparison. We also collected quantitative data through customer interviews. SureCost’s leadership then examined each dataset to address potential anomalies. Finally, we averaged the data to summarize findings, note trends and select salient points to guide other pharmacy professionals.

Data was gathered from 200+ pharmacies.

Opportunities for Savings and Efficiency Through Smarter Purchasing

As in previous years, SureCost extrapolated five key areas where smarter purchasing gives pharmacies a competitive advantage. These areas also demonstrate how successful pharmacies harness robust, flexible technology and business intelligence.

Each section summarizes the data into tables while noting significant trends and identifying specific obstacles. Each area makes a case for smarter purchasing, but (as we’ll explore below) they’re all part of a cohesive solution and strategy.

Pharmacy Purchasing Beyond the Top 200

Pharmacies across the United States frequently make purchasing decisions based on the list of the 200 most commonly prescribed medications. The“Top 200” may also help them gauge demand and keep the right products in stock. While adhering to the Top 200 may seem practical, it doesn’t always contain the best purchasing options.

Purchasing outside the Top 200 unlocks savings opportunities. Pharmacies can also take advantage of more options in a less competitive market. Purchasing outside the Top 200 reduced pharmacies’ cost of goods sold (COGS) by approximately 11% on average. In 2023, retail pharmacies purchased outside the Top 200 at a higher percentage than LTC pharmacies and enjoyed an even lower COGS.

Alongside increased profit margins, accessing a wider range of products opens up bulk discounts, rebates and a chance to negotiate better terms with vendors. Pharmacies also gain another safeguard when drug shortages hit.

COGS savings outside the Top 200

COGS savings within the Top 200

Savings outside the Top 200

Savings within the Top 200

Total savings With SureCost

Savings found on products outside the Top 200

Savings found on products within the Top 200

Mounting challenges with drug shortages

Gain Visibility With Smarter Purchasing

Shopping beyond the Top 200 means substantial savings opportunities and more choices. However, pharmacies need to navigate all those options effectively. The purchasing ecosystem is opaque by design. It obscures purchasing options within a web of vendors, catalogs, categories and purchasing interfaces. Pharmacies may save more but lose money and time searching for the best choice.

A smarter purchasing solution like SureCost enables pharmacies to quickly and easily compare all the options, including their primary vendor, secondary vendors and GPO. Integrating all their catalogs allows pharmacy teams to shop and submit purchase orders through a single interface. The system also monitors of primary vendor compliance while revealing better purchasing options. Pharmacies save more by finding new purchasing opportunities and don’t have to worry about regulatory compliance with their existing agreements.

Monitoring Vendor Substitutions

Vendors substitute products that are different from what pharmacies ordered but don’t always inform recipients of these substitutions. The pharmacy may not find out until they receive deliveries. Unfortunately, many pharmacies don’t even notice the substitution and might not realize its impact.

9.1% Average savings on COGS by purchasing within the Top 200 through SureCost

Average unnotified vendor substitutions among generic purchases

Highest amount of unnotified vendor substitutions among generic purchases

Average increase in COGS due to vendor substitutions

Highest increase in COGS

SureCost customers, on average, encountered vendor substitutions in approximately 0.78% of their generic purchases. That rate may seem low, but it’s actually a slight increase from the previous year’s rate of 0.74%. In other words, vendors were substituting more often that year.

Retail pharmacies experienced higher vendor substitutions compared to LTC pharmacies. For some retail pharmacies, vendors substituted nearly 8% of purchases. This led to an average increase of 0.11% in those pharmacies’ COGS, another slight increase from the previous year. One retail pharmacy with an annual generic spend of roughly $3M saw its COGS increase by over $50K.

Increase Vendor Substitution Awareness

Vendors may not necessarily inform pharmacies about substitutions, and monitoring for them isn’t easy. Checking every package against each purchase order is a tedious process consuming hours that pharmacy professionals don’t have.

If a pharmacy receives a substituted item, SureCost flags the discrepancy and calculates the difference in cost (positive or negative) against the initial purchase order. Pharmacies can spot the issue and address it with their vendor right away. Some pharmacies use SureCost to prevent suppliers from substituting items altogether.

Competitive pharmacies know the value—financial and otherwise—of consistently finding the best purchasing options and never paying for items they didn’t order. By lowering their COGS, they reduce the financial impact of other challenges.

Average percentage of unnotified vendor substitutions among generic purchases

Highest rate of substitutions for one retail pharmacy

Average increase in COGS due to vendor substitutions

Highest increase in COGS for a retail pharmacy with $3M annual purchase volume due to vendor substitutions

Avoiding Sudden Vendor Reorders

Spikes in demand or late drug inventory replenishment make reorders a fact of life for most pharmacies. In 2023, on average, pharmacies reordered 1.67% of their items. LTC pharmacies experienced a slightly higher percentage of reorders compared to their retail colleagues.

Average number of P.O. line items reordered

Average percentage of all items reordered

Highest percentages of reorders

Average increase in COGS due to reorders

Highest increase in COGS

Comparing the percentage of reordered products against the number of line items on a purchase order illustrates the scope of this challenge. Retail pharmacies had to reorder an average of 3,941 line items when the original vendor couldn’t fill their drug orders, while LTC pharmacies averaged 2,738. Even when the total volume was lower, reordering multiple items on the same purchase order meant pharmacies missed out on multiple products.

Drilling down further, some pharmacies had to reorder nearly 30% of items. Due to reorders, pharmacies saw their COGS increase by an average of .19%, which is approximately $5,700 annually. Reorders for one retail pharmacy resulted in an increased annual COGS of almost $5M. These are considerable expenses, and they can easily slip past pharmacy staff.

Anticipate Drug Shortages

Reorders are stressful and pricey, whether due to a vendor’s failure to fill an order or an overworked pharmacy manager unable to check inventory on time. Pharmacies scramble to find another vendor. They must choose between paying more to get the item immediately or failing to fill patients’ prescriptions on time. Sometimes, it takes a time-consuming search from pharmacies to learn about a national drug shortage. This year’s rising drug shortages (see above) led to an increased reorder rate over last year. But, as many pharmacies know, running out of just one item impacts patient health and trust in their pharmacy.

SureCost unifies all vendor catalogs into a single solution and shows pharmacies all in-stock alternative options. Instead of reacting to backorders at the last minute, pharmacies use SureCost’s alerts about potential drug shortages to stay proactive.

Whether it’s replenishing stock before a potential shortage or conducting routine procurement, SureCost always calculates the best purchasing opportunities for the pharmacy. This includes rebate modeling, GPO pricing and vendor specials. Pharmacies maintain consistent, high-quality patient care while lowering COGS and optimizing workflow.

$4,908,299 Highest increase in COGS for one retail pharmacy

Average amount of items that had to be reordered

Highest reorder rate among pharmacies surveyed

Introducing the SureCost Summer Assurance Program

For a limited time only, get $500 off SureCost when booking a demo by August 31st, 2024.

Adhering to GPO Pricing

Group purchasing organizations (GPOs) use their combined buying power to negotiate better product prices, and member pharmacies gain significant savings. Unfortunately, that lower negotiated price is beneficial only if it’s reflected on an invoice. That’s why this year’s Smarter Purchasing Report focused on GPO contract price auditing: discrepancies between prices that pharmacies negotiated through their GPO and the amounts they were invoiced for those contracted products.

Average overcharge for GPO-priced items

Average percentage of spend on overcharged GPO items

Highest percentage of GPO non-compliant total spend

Highest percentage of overspend on incorrectly priced GPO items

Average percentage of total spend on incorrectly priced GPO items

Highest overcharge on GPO items for a pharmacy

54.81% Pharmacy GPO item spend due to incorrect pricing

Every year, on average, pharmacies overspent a quarter percentage point across their total COGS due to GPO price non-compliance. Looking at items that qualify for GPO pricing, on average, about 15% of spending on GPO-qualified products was priced incorrectly, and pharmacies experienced an average overcharge of $102,774. For some pharmacies, as much as 54.81% of their GPO item spend was due to incorrect pricing. LTC pharmacies lost as much as 2.44% of their total annual spend on incorrectly priced GPO items.

While LTC pharmacies encountered higher overcharges for purchased GPO items, retail pharmacies experienced more overcharges on their total spending. Based on SureCost’s experience and customer interviews, this higher rate of overcharges among retail pharmacies may be due to team members lacking the time and tools to check every received item and calculate variances. We can calculate the financial losses. Quantifying the effects on staff time and employee burnout is harder, but pharmacies definitely feel the impact.

Rising staff shortages continue to be a challenge

Pharmacy professionals report higher rates of burnout as they take on even more responsibilities due to a growing and aging patient population.

A Pharmacy Times report found that self-reported burnout more than doubled after the COVID-19 pandemic. In a 2023 Pharmacy Times survey of pharmacists, 76% of respondents cited burnout as contributing to understaffing. 58% of pharmacy professionals surveyed in a 2023 NCPA study reported difficulty filling open positions.

Pharmacy managers must effectively manage the time of their shrinking workforce and help their teams avoid burnout. Optimizing processes and reducing tedious manual processes is crucial. A single purchasing solution lets staff spend less time shopping and more time with patients. The right solution automates repetitive tasks and removes the stress of deciding which products to buy.

Yet pharmacies are advised to find technology that integrates with their existing systems. The right solution helps people do their job; it shouldn’t add hours of training or additional steps to the workflow.

Enhance Purchasing Transparency

Pharmacies must ensure consistent vendor compliance with negotiated prices, whether through a GPO, negotiated with a primary vendor or contracted with any trade partner. However, they also need an efficient, convenient tool to verify that contracted pricing is honored every time they pay an invoice.

SureCost alerts pharmacies when pricing doesn’t reflect the GPO or a vendor fails to honor their quoted contract price. Since it’s part of a unified purchasing management solution, pharmacies have the data and history needed to report the problem when an issue arises. SureCost also standardizes pharmacy purchasing strategy across all team members and locations. Staff can make purchases without worrying about non-compliance with their primary vendor or missing out on tiered pricing for rebates.

0.23% Average total spend on incorrectly priced GPO items

Average overcharge for GPO-qualified items

Average percentage of GPO items priced incorrectly

Highest percentage of annual spend on incorrectly priced GPO items for one LTC pharmacy

Highest percentage of non-compliant GPO spend

Guaranteeing Accurate Value of Received Goods

Pharmacies are also losing money due to disparities between the actual value of goods received and the amount vendors invoice them. Vendors can make mistakes, including:

- Packing a lower quantity of an item

- Not shipping an item

- Invoicing a higher price than the contracted/negotiated rate

- Filling incorrect items and still billing the pharmacy (a.k.a. “miss-picks”)

These are unintentional errors, and vendors can correct them. But the burden is on pharmacies to spot them. They must also communicate them to the vendor—with a sufficient “paper trail” documenting the error—and correct the situation before too much time goes by.

Average variance overpaid

Maximum variance overpaid

Highest dollar difference between invoice vs. value of received items

Ensure Accountability

Pharmacies need to know they’re getting what they paid for. Integrating with a pharmacy’s existing systems (like accounts payable and pharmacy management systems), SureCost allows pharmacy teams to instantly compare invoices against purchase orders as soon as they receive items. Team members gain a single interface for a streamlined workflow. Pharmacies can be confident that they always get the right product at the correct amount for the agreed-upon price and can quickly and easily rectify any issues.

Highest percentage of total annual spend on overpaying for incorrect/unreceived items

Takeaways for Smarter Purchasing

The above data and the guidance collected from interviews with these pharmacy professionals illustrate a few overarching strategies—starting with streamlined purchasing. These pharmacies don’t waste time and miss out on savings by juggling catalogs or uploading multiple purchase orders. Instead, with all of their vendors unified into a single solution, they view unit prices for all purchasing options for each item from every vendor, down to the NDC, and purchase through a single interface.

Summary of Savings Potential

(Based on $3M Annual Purchasing Volume)

Purchasing Generics Beyond and Within the Top 200

Monitoring Vendor Substitutions

Avoiding Sudden Re-Orders

Adhering to GPO Pricing

Guaranteeing Accurate Value of Received Goods

TOTAL

0.35% Average percentage of total annual spend on overpaying for incorrect/ unreceived items

They’re also confident in their data. Accurate, updated catalogs tell them which products are available and flag the best options. Invoices verified against pharmacy purchasing history and contract pricing ensure they always get what they paid for. A complete virtual paper trail lets them report issues to vendors. All that data generates business intelligence metrics to formulate purchasing strategies.

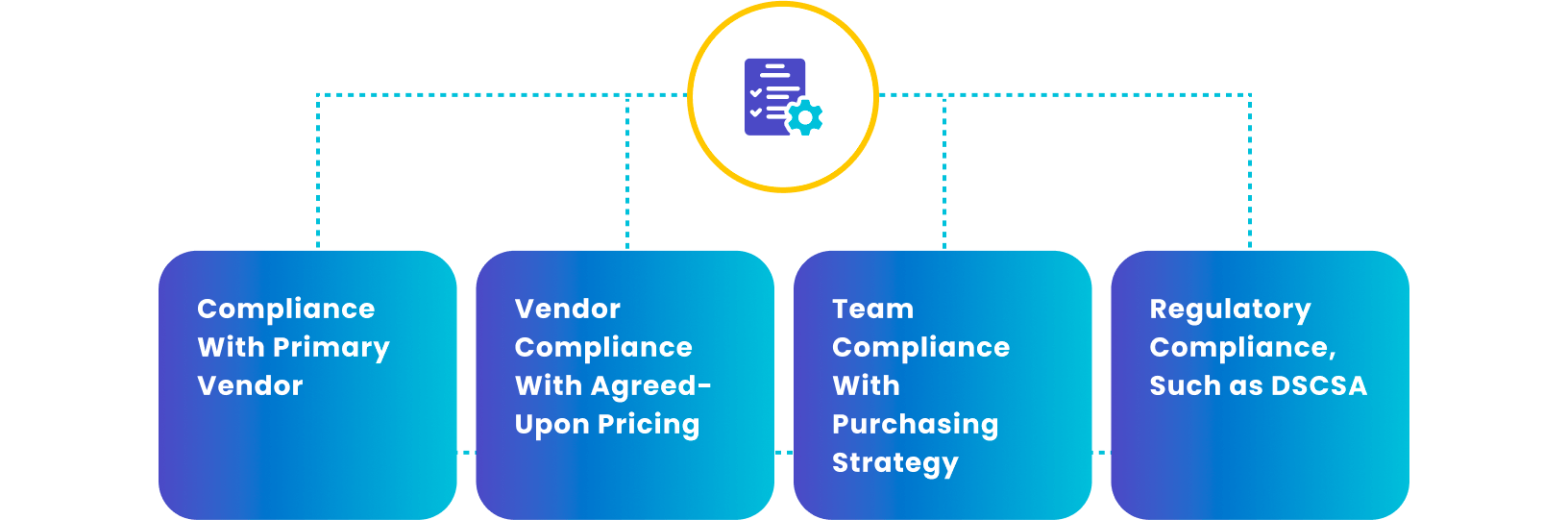

These pharmacies also look at compliance from several angles:

A unified purchasing solution ensures they have guardrails to manage all these areas even as they expand their vendor portfolio.

Technology also empowers them to automate manual processes and repetitive tasks. Instantly verifying an invoice against a purchase order (as outlined above) is one example. Another is using a smarter inventory management solution to alert them when stock reaches a certain level and automate replenishment based on purchasing history.

Above all, the key takeaway is to manage purchasing, inventory and compliance as a unified system. Siloing these processes creates more work for everyone. Instead, integrate pharmacy purchasing and inventory management into a single source of truth. DSCSA compliance updates make this level of integration even more important. Separate systems may lead to overcharging, but they could now result in regulatory compliance penalties.

New DSCSA compliance requirements add further challenges

New DSCSA regulations will require pharmacies to verify products at the package level when receiving items and store data based on new electronic standards. This is a complex set of data with rigorous standards, and it’s risky to record and capture it using separate processes.

An integrated purchasing and inventory solution lets pharmacies track and receive all that data as soon as they scan and receive items. In the event of an audit, pharmacies can easily furnish requested information in the correct format. They should also ensure that the team behind the solution understands the new DSCSA requirements; the technology should accommodate the regulations precisely without burdening the pharmacy.

What’s Next in Pharmacy Purchasing?

Download the white paper

Complete this form to get the PDF version of our report.